04 May 2023

Affordable housing investment in Northern Ireland meets targets amid political uncertainty

The UK housing ‘bible’ – the 2023 UK Housing Review – was published at the end of March with a launch event at the House of Lords. The host of the event, Lord Richard Best, described the publication as ‘The essential encyclopaedia of housing data and the stimulus for informed discussion on the key housing issues.’

You can see why it inspires these plaudits. The annual publication is packed with statistics and analysis about housing, households, and welfare benefits across the UK and internationally. We sat down to examine the 2023 UK Housing Review through a local lens and see what the latest analysis and data tells us about the how the social housing sector is performing in Northern Ireland.

Cross-UK comparisons of government housing investment

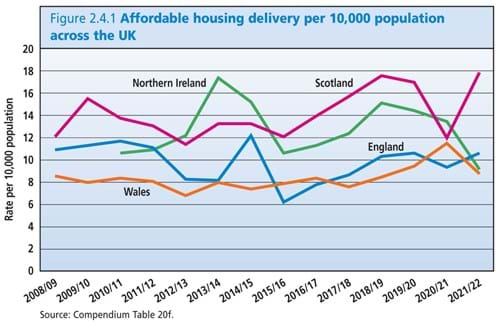

Three different cross-UK comparisons show that England under-invests in affordable housing compared with the three devolved nations. Last year for the first time, the 2022 edition of the Review compared levels of affordable housing output across the UK, by assessing delivery in terms of numbers of homes built per 10,000 population.

The data presented in the 2023 review clearly shows how Scotland leads in this measure of affordable output, with Northern Ireland closely behind.

Affordable housing delivery per 10,000 population across the UK

Northern Ireland leads, too, on the other two measures. It has the highest share of government spending devoted to housing and is also the only administration where 100 per cent of investment is on affordable housing, as opposed to stimulating the private market.

Affordable housing investment in Northern Ireland

However, there are caveats to the favourable assessment. In 2021, the DfC published a 15-year draft Housing Supply Strategy 2022-2037, with the aim of delivering ‘upwards of 100,000 homes over its lifetime’. One-third of these would be social housing, implying an annual target of over 2,200 new social homes.

But what soon followed in February 2022, was the collapse of the power-sharing institutions in Northern Ireland over the future of the Northern Ireland Protocol and trade checks at the ‘Irish Sea border’, once again leaving Northern Ireland without its own assembly or government.

Consequently, there is no agreed multi-year budget or progress on the DfC strategy, while the political impasse has also interrupted the revitalisation of the Northern Ireland Housing Executive, which is a vital factor in addressing the backlog of investment in the existing social housing stock.

Northern Ireland Social Housing Development Programme - completions 2017/18-2022/23

| Type of provision | Totals 2017/18 - 2021/22 | Average per year | Totals April to December 2022/23 | On target April to March 2022/23 projections |

| New build | 5,295 | 1,059 | 721 | 961 |

| Off the shelf | 780 | 156 | 147 | 196 |

| Existing satisfactory purchase | 469 | 94 | 11 | 14 |

| Rehabilitation | 145 | 29 | 95 | 127 |

| Re-improvement | 265 | 53 | 0 | 0 |

| Totals | 6,954 | 1,390 | 974 | 1,298 |

Comparing these figures to the housing supply aspiration of around 2,200 new social homes a year, it is clear we have some way to go in closing the gap between what we are currently building and where we need to be.

Playing Catch-up

We have a long way to go to catch up on the number of homes needed and we are still unsure of when we will see NI Executive return to Stormont and set budgets for the coming years.

Acquiring new sites for social housing is not without its own challenges as there is a limited amount of land that can be used for housing development in the areas of greatest need. However, housing organisations are ploughing ahead securing land for new development opportunities and continually working towards closing the gap on the number of social homes needed in NI. The last few weeks have seen announcements from various organisations about new build developments in Ballymurphy, Belfast, Buncrana Road, Londonderry and Ballinderry Road, Lisburn to name a few.

The demand for more social housing remains high. For example, the Northern Ireland Housing Executive has projected a housing need of 1,107 homes for Middle West Belfast for 2022-27 as the waiting list in that part of the city has increased by 48 per cent since 2017.

Developing housing policy and options

Some housing policy development is continuing as we have seen DfC launch their plans to promote housing at Intermediate Rents. This is an outcome of the CIH Northern Ireland housing policy review in 2018, and the result of co-design between the Department for Communities, CIH and the housing sector. Intermediate rent represents an option for people who can pay more than social rents, but for whom market rents are difficult to afford. It will take time to begin to deliver these new homes, but they represent an additional choice for low to moderate income households.

What next for the social housing sector in NI?

The analysis shows us that Northern Ireland has the potential to deliver effective social housing. However, without a healthy power-sharing system in Stormont progress is stalling at a time when demand for affordable housing is rapidly rising. An effective government is crucial for the social housing sector to function well and help organisations meet housing needs. CIH will continue to work with government and other organisations to prioritise affordable housing supply for Northern Ireland.

The UK Housing Review series is the housing sector's leading annual statistical publication, packed with statistics and analysis about housing, households and welfare benefits across the UK and internationally.

Published by CIH it is free to download for all CIH members as part of their member benefit package.

The Review can be purchase via the CIH bookshop for anyone who doesn't have a CIH membership.

Julie is is an engagement and external affairs manager for CIH NI.